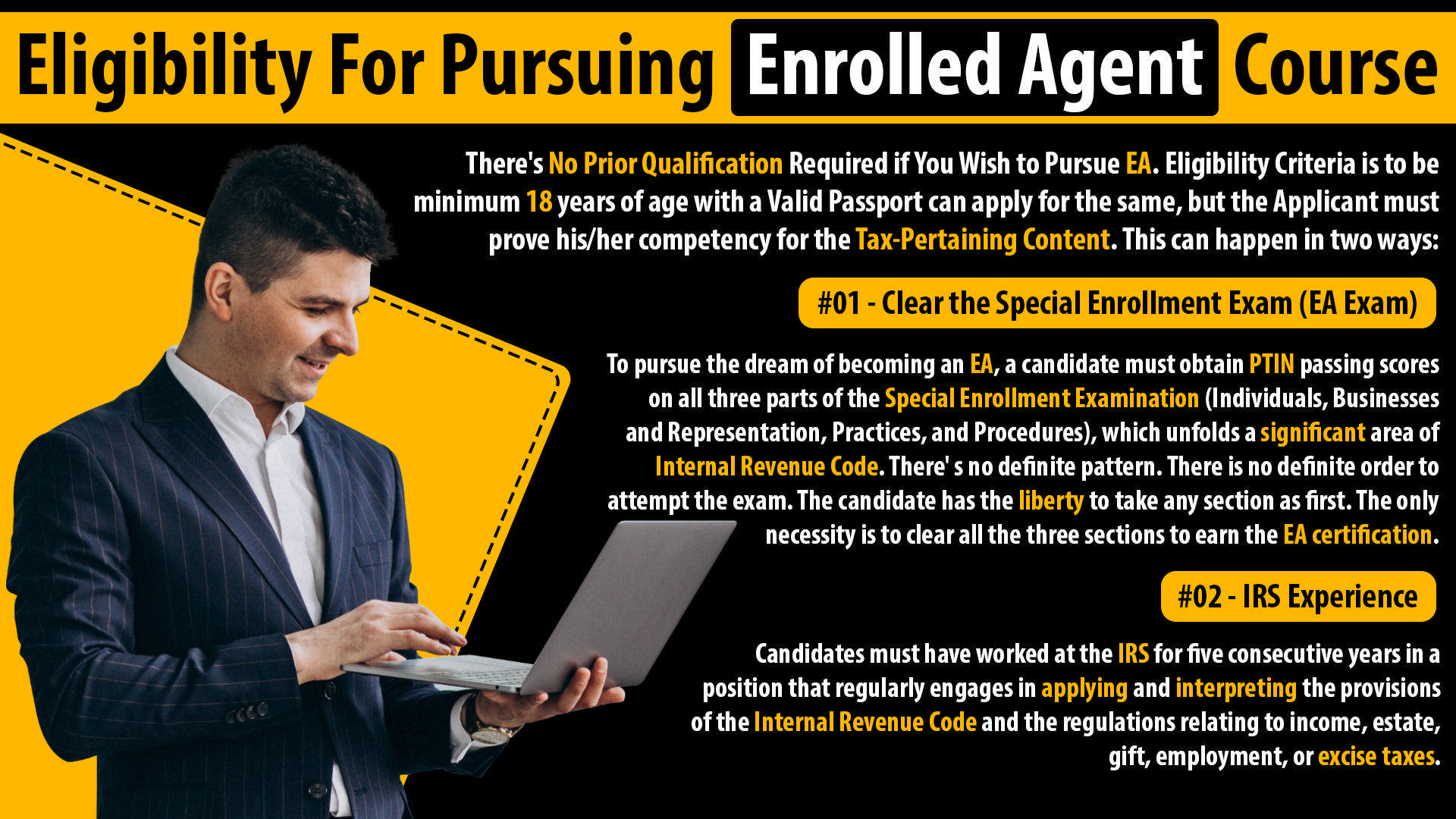

Do you have these Questions? Who is an Enrolled Agent? How can one become an EA? How much time does one take to acquire the Tax Credential? Where can it be Practiced? What is the eligibility criteria to enroll for the EA course? How does it differ for the other tax credentials offered by the US government? Questions on Course syllabus and exam pattern? Where will the examination be conducted? In what ways does iLead help to make you an USA Tax Expert/ practitioner?

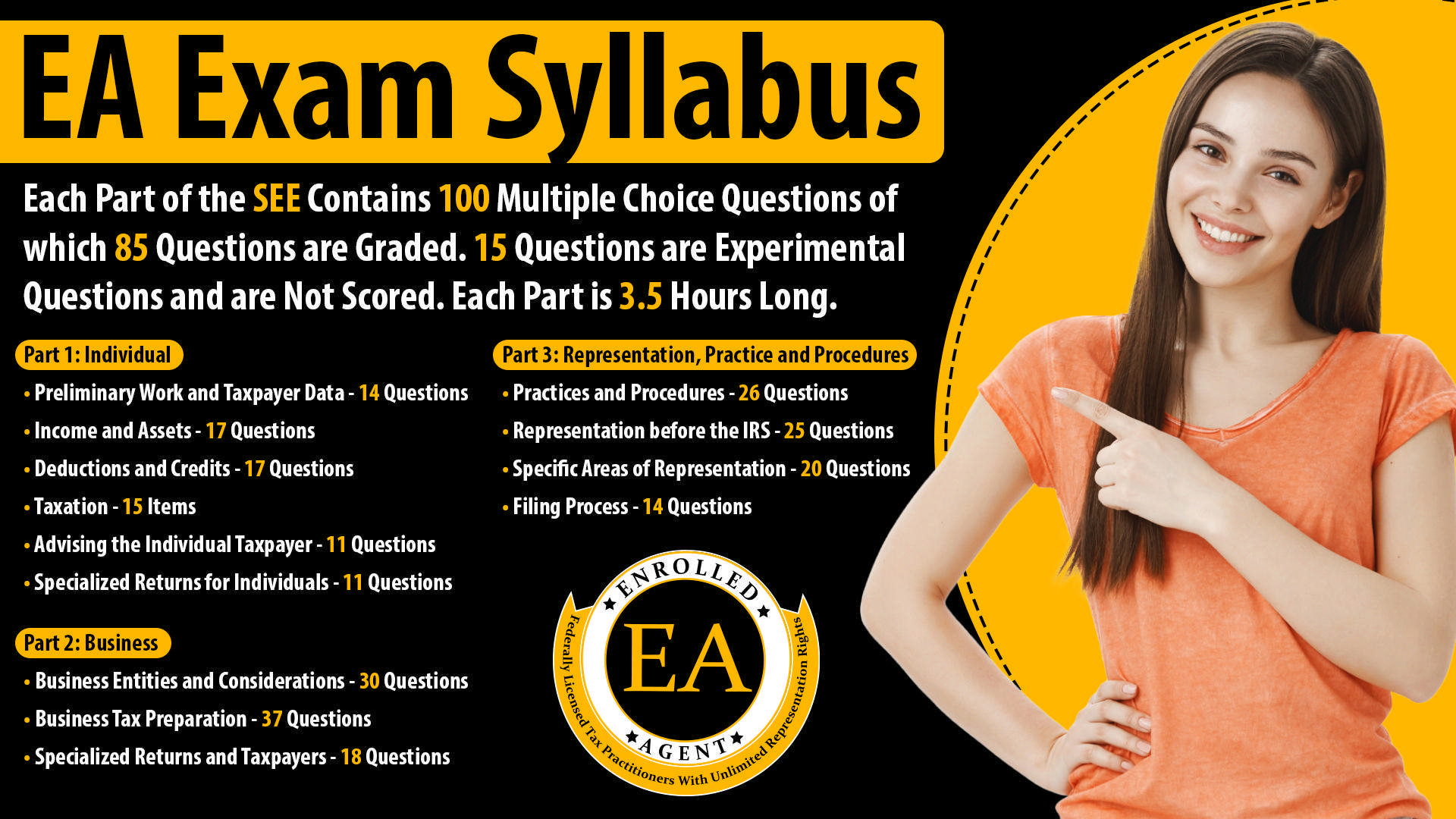

Click Here to Check Out the Enrolled Agent License Syllabus

Solve Daily MCQ Video On My Career Qitaab (MCQ) on

For more information on EA Training and Offers check out our blog posts. You can also follow our Social Media pages for more Updates